Our

Blog

-

Realtors expand Your Client's Options with Florida Real Estate Auctions

-

- Andres McBeth

- 2025-09-06T04:00:00Z

- Share

Guiding Your Clients Through the Auction Process

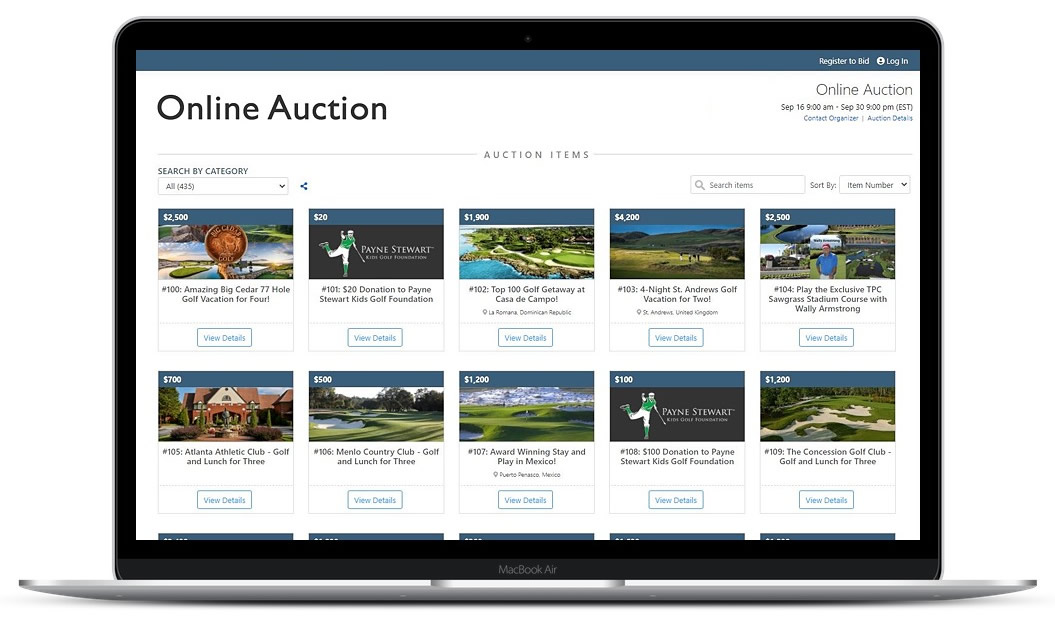

In Florida's highly competitive real estate landscape, staying ahead means offering your clients every possible advantage. For many real estate agents, that means looking beyond the traditional Multiple Listing Service (MLS) to a powerful, often overlooked tool: the online real estate auction marketplace.

Historically, real estate auctions were associated with distressed properties, cash-only buyers, and courthouse steps. Today, that perception is outdated. Modern online platforms are transparent, efficient, and represent a new frontier for both buyers and sellers. By integrating real estate auctions into your service offerings, you're not just expanding your business—you're positioning yourself as a versatile, market-savvy professional.

Why Online Auctions are a Realtor's Secret Weapon

As a realtor, your value lies in your expertise and your ability to present your clients with the best possible solutions. Here’s how online auctions give you a serious edge:

-

Access to Unique, Exclusive Inventory: The properties on auction platforms often include foreclosures, bank-owned (REO) homes, and even luxury estates that haven't hit the traditional market. This provides you with an exclusive portfolio of homes that can attract a wider range of buyers, from first-time homeowners to experienced investors.

-

The "Co-op" Commission Opportunity: A common misconception is that realtors don't earn commissions on auction sales. In reality, many online auction marketplaces offer a co-op commission to the buyer's agent. This allows you to earn commissions on properties that are sold quickly and efficiently, opening up a new revenue stream for your business.

-

Faster Sales Cycle: For clients who need to sell quickly—perhaps due to a relocation, estate liquidation, or a need for cash—auctions provide an unparalleled solution. Properties can go from listed to sold in a matter of weeks, far shorter than the average traditional sale cycle in Florida. As the listing agent, you can offer this speed and certainty as a powerful selling point.

Guiding Your Clients Through the Auction Process

The transition from a traditional to an auction-based sale requires your expertise. Your role as a guide and advisor becomes more critical than ever.

-

For Buyers: You're their shield. Guide them through the crucial due diligence process, from understanding the "as-is" condition of the property to vetting the title for any hidden liens or fees. Help them set a firm, unemotional bidding strategy and ensure their financing is in order for the fast closing timeline. Your value is in providing the knowledge and caution that prevents a dream deal from becoming a nightmare.

-

For Sellers: You're their strategist. Educate your clients on the benefits of an auction sale, such as a transparent process, a defined sale date, and competitive bidding that can drive up the final price. Manage the marketing and ensure the property is positioned to attract the right kind of attention from qualified, motivated buyers.

Elevate Your Brand and Authority

By successfully facilitating auction transactions, you'll build a reputation as an adaptable and innovative agent. This expertise sets you apart from the competition and helps you capture a segment of the market that many other realtors ignore. You'll be seen as the go-to professional who can offer a full spectrum of real estate solutions, no matter the client's unique needs.

Incorporating online real estate auctions into your business isn't just about selling more homes; it's about growing your professional brand and providing a higher level of service to your clients. Get ahead of the curve, register with a leading marketplace, and start expanding your clients’ horizons today.

Read More -

-

The 3 Things You Must Do Before You Bid

-

- Andres McBeth

- 2025-09-05T04:00:00Z

- Share

Don't Bid Blind! The 3 Things You Must Do Before You Bid on a Florida Property

Buying a home is one of life's biggest milestones. In a vibrant, competitive market like Florida, the idea of an online real estate auction can be incredibly appealing—it promises speed, transparency, and the chance to land a fantastic deal. But for first-time bidders, this arena can feel like a high-stakes gamble.

The key to turning that gamble into a calculated, winning strategy? Due diligence. Unlike a traditional sale, the responsibility to investigate the property falls almost entirely on you, the buyer. Before you even think about placing that first bid on a property in Hialeah or elsewhere in the Sunshine State, you must complete these three non-negotiable steps.

1. Conduct a Thorough Title Search for Liens and Encumbrances

Imagine winning your dream home at a great price, only to discover you've also inherited a mountain of debt. In a traditional sale, the title company and seller’s disclosures would handle this, but in an auction, it's all on you.

A title search is a deep dive into the property's public records to identify any existing legal claims or financial obligations. This is crucial because a property can be sold at a Florida auction with various liens attached, including unpaid property taxes, outstanding mortgage debt, or even HOA fees. These debts don’t disappear with the sale; they become your responsibility.

Working with a knowledgeable Florida real estate attorney or a reputable title company before you bid is the only way to get a clear picture of what you're buying. They can uncover any surprises and give you the confidence to bid—or walk away.

2. Understand the Property's Condition (The "As-Is" Rule)

The golden rule of real estate auctions is that properties are sold "as-is." This means the seller is not responsible for any repairs, damages, or deficiencies—not before the sale, not after. For a first-time homebuyer, this is a significant risk that must be carefully managed.

While you might not have the luxury of a 10-day inspection period, you must do everything in your power to assess the property's condition.

-

Physical Inspection: Some auction platforms offer a limited time for inspections. Take full advantage of this. Hire a professional inspector to do a walk-through and look for major red flags like roof damage, foundation issues, or signs of mold.

-

Drive-By Assessment: At a minimum, drive by the property at different times of day. Check out the neighborhood, look for any external damage, and note the condition of surrounding homes. This simple step can reveal a lot about the property and the area.

-

Estimate Repair Costs: Assume the worst and estimate the cost of major repairs. Build a buffer into your maximum bid to cover these expenses. If a property is a steal, it’s often because it needs significant work.

Without a clear understanding of the property's condition, you're bidding blind.

3. Know All the Auction Terms and Fees (The Fine Print Matters!)

It’s not just about the winning bid. The final price you pay can be significantly higher due to hidden fees and rules. Don’t get caught off guard.

-

The Buyer’s Premium: This is a key fee in most online auctions. It’s a percentage of the winning bid that you pay to the auction house for their services. For example, if you win a property for $200,000 with a 5% buyer's premium, you'll pay an additional $10,000, bringing your total to $210,000. This must be factored into your budget from the very beginning.

-

Deposit Requirements: Be prepared to submit a non-refundable deposit—often a significant percentage of the purchase price—immediately after the auction closes.

-

Closing Timeline: Auction closings are fast. If you're using financing, you must have a lender who is prepared to work on an accelerated timeline, or you risk forfeiting your deposit.

Online real estate auctions offer an exhilarating path to homeownership in Florida. But success isn't about luck; it's about preparation. By taking the time to conduct a thorough title search, realistically assess the property's condition, and understand every fee and rule, you can transform the high-stakes game of bidding into a smart, confident strategy that lands you the perfect property.

For more information: Visit us @ auctiontrade.ai or call 305 871 9896

Read More -

-

How First-Time Homebuyers Succeed at Online Real Estate Auctions?

-

- Andres McBeth

- 2025-07-09T09:00:00Z

- Share

Dreaming of Your First Home? Decoding Online Auctions for Miami Newcomers!

Buying your first home is a monumental achievement, a true rite of passage. For many, it's a journey filled with open houses, competitive offers, and sometimes, a bit of frustration. But what if there was an alternative path that could potentially fast-track you to homeownership, perhaps even in a competitive market like Miami or Tampa?

We're talking about online real estate auctions. You might be thinking: "Aren't those just for seasoned investors?" Or "Isn't it too risky for a first-timer?" The short answer is: Yes, first-time homebuyers can succeed at online real estate auctions. However, it's not a shortcut, and it comes with its own unique set of rules and considerations. Let's break it down!

Why First-Time Buyers Are Looking at Auctions (and Why They Should!)

The appeal of online auctions for new homebuyers is clear:

-

Potential for a "Deal": This is often the biggest magnet. Properties, especially foreclosures or bank-owned (REO) homes, can sometimes be acquired below their traditional market value. Imagine getting more for your money in Hialeah!

-

Speed and Efficiency: The auction process is typically much quicker than conventional home purchases. If you're eager to move into your new home, an auction could shorten your timeline significantly.

-

Transparency: Unlike traditional negotiations, online bidding is often visible in real-time. You see the competition, which can help you gauge demand and value.

-

Unique Inventory: Auctions offer access to properties that might not hit the traditional Multiple Listing Service (MLS). This can include distressed properties that are perfect for those willing to put in some sweat equity.

-

Convenience: Bid from anywhere with an internet connection – no need to carve out weekends for endless open houses.

The Real Talk: Key Challenges for First-Time Auction Bidders

While the upsides are enticing, it's crucial to be realistic. Online auctions aren't a walk in the park, especially for the uninitiated:

-

"As-Is" Sales are Standard: This is the most significant hurdle. Most auction properties are sold "as-is," meaning the seller will not make any repairs. For a first-time buyer, this carries substantial risk. Hidden issues like a faulty HVAC system, a leaky roof, or structural problems can quickly eat into (or erase!) any perceived savings.

-

Limited (or No) Inspection Periods: Unlike traditional sales, you often don't get the luxury of a full inspection contingency. You might have a limited viewing window, or even just exterior access. This makes understanding the property's true condition incredibly difficult.

-

Cash or Unconditional Financing: Many auctions, particularly foreclosure sales, require cash or a loan pre-approval that does not have a financing contingency. If you win and your financing falls through, you could forfeit a substantial earnest money deposit. This is a major barrier for many first-time buyers who rely on standard mortgages.

-

Competition with Pros: You'll be bidding against seasoned real estate investors who are experts at valuing properties, estimating repair costs, and navigating the auction landscape. They operate with less emotion and more calculation.

-

Hidden Costs & Liens: Some auction properties may come with outstanding property taxes, HOA dues, code violations, or other liens that become the buyer's responsibility after the sale. A thorough title search is non-negotiable.

-

Tight Timelines: From deposit submission to closing, everything moves fast. If you're not organized and prepared, you can quickly feel overwhelmed.

-

Potential Occupants: In some foreclosure scenarios, previous owners or even tenants might still be living in the property. Eviction processes, which fall to the new owner, can be lengthy, costly, and emotionally draining.

Your Roadmap to Auction Success: Essential Steps for First-Timers

Despite the challenges, success is achievable with the right approach. Here’s your game plan:

-

Get Your Finances in Impeccable Order:

-

Solid Pre-Approval: Work with a lender experienced in auction properties. Get a robust pre-approval letter for an amount less than your absolute maximum, giving you a buffer.

-

Cash Reserves are King: Beyond your down payment and closing costs, have a significant emergency fund for immediate repairs and unexpected issues.

-

-

Master the Due Diligence Process (It's Non-Negotiable!):

-

Research, Research, Research: Dive deep into property records, tax history, zoning laws, and any publicly available information.

-

Local Market Expertise: Work with a local Hialeah real estate agent who understands auction properties and the unique dynamics of our local market. They can help with comparable sales and neighborhood insights.

-

Physical Inspection (If Allowed): If there's any opportunity to view the property, seize it! Bring a contractor or a knowledgeable friend to assess potential repair costs.

-

Title Search: Hire a reputable title company before you bid to uncover any liens, encumbrances, or ownership issues. This protects you from inheriting someone else's debt.

-

Read the Fine Print: Each auction platform and property has specific terms and conditions. Pay meticulous attention to buyer's premiums, deposit requirements, closing timelines, and "as-is" clauses.

-

Know the Auction Type: Understand if it's an "absolute auction" (sells to the highest bidder regardless of price) or a "reserve auction" (seller has a minimum acceptable price).

-

Observe First: Before bidding on a property you actually want, spend time observing several online auctions. Get a feel for the pace, the bidding increments, and how it all works.

-

Set a Strict Max Bid: Determine your absolute highest bid (including all fees and estimated repairs) before the auction starts, and stick to it. Don't get caught up in bidding fever.

-

Understand Every Detail of the Auction:

-

Practice Makes Perfect (Almost):

The Bottom Line: Is an Auction Your First Home Sweet Home?

For the right first-time homebuyer, online real estate auctions can indeed be a fantastic avenue to homeownership in Hialeah or anywhere in Florida. If you are:

-

Financially prepared with strong reserves.

-

Disciplined and able to stick to a budget.

-

Willing to invest significant time in due diligence.

-

Comfortable with a higher level of risk and potential for repairs.

-

Eager to potentially uncover a great deal.

Then exploring online real estate auctions might just be the bold, smart move that leads you to your first dream home. Just remember: preparation is your superpower!

Read More -

-

The Ultimate Guide to Buying Your First Home at Online Auction

-

- Andres McBeth

- 2025-07-08T04:00:00Z

- Share

Ready to Bid Your Way Home? Your Guide to Online Real Estate Auctions!

Buying your first home is a monumental step, full of excitement, a little bit of nerves, and a whole lot of questions. But what if we told you there's a powerful, often overlooked avenue that could lead you to your dream home and potentially some amazing deals? We're talking about online real estate auctions!

Forget the dusty image of a traditional auction house. Today's online property auctions are sleek, transparent, and incredibly accessible, opening up a world of opportunities for first-time homebuyers. Sound intriguing? Let's dive in!

Why Consider an Online Auction for Your First Home?

You might be wondering, "Aren't auctions just for investors or people looking for distressed properties?" Not anymore! Here's why online auctions are becoming a go-to for savvy first-time buyers:

-

Potential for Great Deals: Properties can often sell below market value, especially if they're bank-owned (REO) or foreclosure properties where the seller wants a quick sale.

-

Efficiency & Speed: The auction process is typically much faster than traditional home buying, often closing in a matter of weeks.

-

Transparency: You see the bids as they come in, giving you a clear picture of the competition and the property's real-time value.

-

Wider Selection: Online platforms aggregate properties from various sources, giving you access to a broader inventory that might not be listed through traditional real estate agents.

-

Convenience: Bid from your couch! No need to travel to open houses or physical auctions.

Navigating the Auction Landscape: Types of Properties You'll Find

Online auctions feature a variety of property types, each with its own nuances:

-

Foreclosures: Homes where the owner has defaulted on their mortgage, and the lender is selling the property to recover the debt. These can be fantastic deals but often come "as-is."

-

Bank-Owned (REO) Properties: If a foreclosure doesn't sell at auction, it becomes an REO property, owned by the bank. Banks often want to move these quickly and may offer more flexible terms.

-

Estate Sales: Properties being sold as part of an estate, often by family members looking for a streamlined sale.

-

Government-Owned Properties: Agencies like the HUD (Housing and Urban Development) often auction off properties.

-

Privately Listed Properties: Some sellers simply choose the auction format for its efficiency and competitive bidding.

Your Pre-Auction Checklist: Don't Bid Blind!

This is arguably the most crucial step. Think of it as your secret weapon. Before you even think about placing a bid, you must do your homework.

-

1. Get Pre-Approved for Financing (Seriously!): Most online auctions require proof of funds or a pre-approval letter. Know your budget before you start looking. Cash buyers have an advantage, but financing is absolutely possible.

-

2. Read the Fine Print: The Auction Terms & Conditions: Every auction platform and property will have specific rules. Pay close attention to:

-

Buyer's Premium: An additional fee (percentage of the winning bid) you'll pay to the auction house.

-

Deposit Requirements: How much do you need to put down immediately if you win?

-

Closing Timeline: How quickly do you need to close the deal?

-

Inspection Period: Is there one? (This is vital!)

-

"As-Is" Clauses: Many auction properties are sold "as-is," meaning the seller won't make repairs.

-

-

3. Due Diligence is Your Best Friend:

-

Property Research: Dig deep! Check property records, zoning, liens, and any outstanding taxes.

-

Physical Inspection (If Possible): If the auction allows it, hire a professional home inspector. This investment can save you from costly surprises.

-

Neighborhood Scout: Drive by the property at different times of day. Research schools, local amenities, and crime rates.

-

Comparative Market Analysis (CMA): Work with a real estate agent (experienced in auctions, if possible!) to understand comparable sales in the area. This helps you determine a realistic maximum bid.

-

Absolute Auction: Property sells to the highest bidder, no matter the price.

-

Reserve Auction: Seller has a minimum price they're willing to accept. If the bids don't meet it, they can reject the highest bid.

-

Minimum Bid/Starting Bid: The lowest acceptable bid to open the auction.

-

4. Understand the Bidding Format:

The Big Day: Bidding Strategies for Success

It's auction day! You've done your homework, you know your limits, and you're ready.

-

Stay Calm and Focused: It can be exhilarating, but don't get swept up in bidding wars. Stick to your pre-determined maximum bid.

-

Bid Smart, Not Emotional: Don't let emotion drive your bids. Every dollar counts.

-

Consider a Proxy Bid: Some platforms allow you to set your maximum bid, and the system will automatically bid for you up to that amount.

-

Be Ready for a Quick Decision: Auctions move fast. Be prepared to act decisively.

You Won! What Happens Next?

Congratulations! You've won the bid. Now, the real work (and excitement!) begins.

-

Sign the Purchase Agreement: This usually happens immediately after the auction closes.

-

Submit Your Deposit: Be prepared to transfer the required deposit funds promptly.

-

Secure Your Financing: Work closely with your lender to finalize your mortgage.

-

Closing: Once all conditions are met and financing is secured, you'll proceed to closing, just like a traditional home purchase. Get ready to receive the keys to your new home!

Is an Online Auction Right for You?

Buying a home at an online auction can be an incredibly rewarding experience, offering unique opportunities for first-time buyers. It requires thorough preparation, a clear understanding of the process, and a bit of a strategic mindset.

If you're someone who loves a good deal, is comfortable with independent research, and thrives on efficiency, then diving into the world of online real estate auctions could be your perfect path to homeownership. Do your homework, stay disciplined, and happy bidding!

Read More -

-

How to Spot Profitable Auction Deals in Real Estate

-

- Andres McBeth

- 2025-06-07T16:34:00Z

- Share

Online real estate auctions are a goldmine for savvy buyers—**if you know what to look for**. Whether you're flipping, renting, or buying below market value, spotting a profitable deal comes down to due diligence, timing, and strategy.Here are **5 tips** to help you identify the best opportunities:## 🔍 1. Compare Current Market ValuesAlways compare the auction property’s starting bid or reserve price to **recent comps** in the same area. Look for a spread that allows for profit after renovation and closing costs.✅ **Pro Tip:** Use tools like Zillow, Redfin, or a local MLS to check nearby sold prices.## 🧾 2. Review the Due Diligence PackageAuction platforms typically provide title reports, disclosures, inspection summaries, and photos. Review everything carefully to understand **repair costs, liens, or tenant status**.🚩 **Red Flag:** Missing documents or unclear tenant situations could signal risk.📍 3. Focus on Location ValueTarget properties in **up-and-coming neighborhoods**, near schools, transit, or major employers. Even distressed homes in growing areas can offer long-term upside.📈 Look for signs of gentrification or new development nearby.⏳ 4. Look for Shorter Time on MarketProperties that have just hit the auction block often attract less competition than relisted or extended auctions. Jumping on early listings can lead to lower winning bids.💸 5. Set a Strict Budget & ROI GoalProfitable deals start with discipline. Know your max bid, estimated repair costs, holding time, and **target ROI (e.g., 15–20%)**. Never let bidding emotion blow your budget.📸 Suggested Images:1. **Investor analyzing market data on laptop*** [Pexels – Mikhail Nilov](https://www.pexels.com/photo/person-in-white-long-sleeve-shirt-using-macbook-pro-8297495/)2. **Before and after renovation photo collage*** Use stock photo sites or Canva to create transformation visuals.3. **Auction bidding countdown screen*** Screenshot from your platform or design a mockup.🎯 Final ThoughtFinding great deals at online auctions is all about being informed, strategic, and patient. With the right tools and mindset, your next profitable investment could be just one bid away.Register for access to off-market and auction-only deals!Read More -

-

Top 5 Mistakes to Avoid When Bidding in Online Real Estate Auctions

-

- Andres McBeth

- 2025-05-24T21:25:00Z

- Share

Online real estate auctions have opened the door for buyers and investors to access discounted properties, transparent bidding, and faster closings. But while the opportunity is real, so are the risks—especially if you jump in unprepared.1. Bidding Without Doing Proper Due Diligence- The Mistake: Jumping into a bid based solely on photos or price.

- Why It’s Risky: Many auction properties are sold as-is, and skipping inspections or title research can lead to costly surprises like liens, legal issues, or major repairs.

How to Avoid It:- Review all disclosures, inspection reports, and property summaries

- Run a title search or work with a title company

- Understand neighborhood comps and zoning restrictions

- Drive by or schedule a walk-through if allowed

2. Ignoring the True Cost of Winning- The Mistake: Winning the auction—then realizing you paid more than you thought.

- Why It’s Risky: Many online auctions include a buyer’s premium (often 5–10% of the final bid) and non-refundable deposits. Add that to closing costs, repairs, and financing, and the “deal” might not pencil out.

How to Avoid It:- Read the full auction terms & conditions

- Add buyer’s premium to your total bid limit

- Factor in taxes, escrow fees, and potential renovations

- Use a deal analyzer or ROI calculator before bidding

3. Not Understanding Auction Types and RulesWhy It’s Risky: Auction formats vary—some have reserve prices (minimum sale price), while others are absolute (no reserve). In some cases, the seller must approve the winning bid after the auction ends.The Mistake: Treating every auction the same.How to Avoid It:- Know if the auction is absolute, reserve, or subject to confirmation

- Understand how bid extensions work (some platforms auto-extend if a bid comes in during the last minutes)

- Make sure your financing is ready if required

⏳ 4. Waiting Until the Last Minute to BidThe Mistake: Planning to swoop in and win in the final seconds.- Why It’s Risky: Many platforms have anti-sniping rules, meaning last-minute bids extend the auction by several minutes. If you're not watching closely, you could miss your chance.

How to Avoid It:- Set alerts and monitor your target property closely

- Place strategic early bids to stay in the game

- Don’t rely solely on last-second timing—set a max bid strategy and stay alert

5. Letting Emotions Take OverThe Mistake: Getting caught in a bidding war and blowing your budget.- Why It’s Risky: Auctions are exciting, and it’s easy to overbid in the heat of the moment. But winning a property at the wrong price can lead to negative equity, cash flow issues, or failed flips.

How to Avoid It:- Set a hard budget and stick to it—no exceptions

- Use a max auto-bid feature (if available)

- Remember: there’s always another auction

Conclusion & Call to ActionOnline property auctions offer incredible opportunities—but only if you play it smart. By avoiding these five common mistakes, you can protect your investment, win better deals, and build confidence with every bid.Looking for your next smart buy? Browse Upcoming AuctionsRead More -

-

Investor Insights: Maximizing Profits Through Online Property Auctions

-

- Andres McBeth

- 2025-05-31T04:00:00Z

- Share

For real estate investors, timing, access, and pricing are everything. In today’s fast-moving market, savvy buyers are shifting to online real estate auctions to gain an edge. These platforms provide faster transactions, access to off-market deals, and an opportunity to acquire properties at below-market pricing—often without the friction of traditional listings.Whether you’re flipping, holding, or wholesaling, this post outlines how to maximize your ROI with online auctions and avoid common pitfalls.🧭 1. Why Online Auctions Appeal to InvestorsOnline property auctions offer a range of benefits for both new and seasoned investors:✅ Speed – Closings often happen in 30 days or less✅ Transparency – Competitive bidding sets real market value✅ Inventory Access – MLS, off-market, and REO properties available✅ Nationwide Reach – Invest in new markets without travelingInvestors love the ability to source deals without waiting months for negotiations or seller counteroffers.🔍 2. How to Spot Profitable Auction DealsThe key to success is knowing what to bid on—and what to walk away from. Look for:- Undervalued properties in growing or undervalued neighborhoods

- Homes with cosmetic damage that can be easily flipped

- Rental-ready units in high-demand markets

- Motivated sellers using auctions to move quickly

- Use online tools like Zillow, Redfin, or Rentometer to compare local comps and rental yields.

📊 3. Run the Numbers Like a ProBefore bidding, analyze every deal thoroughly:- After Repair Value (ARV) – What could the property sell for once fixed?

- Renovation Costs – Get contractor estimates before the auction closes

- Holding Costs – Taxes, utilities, insurance, etc.

- Buyer’s Premium – Often 5–10% of the purchase price

- Exit Strategy – Will you flip, rent, or wholesale?

- Use a spreadsheet or deal analyzer app to ensure you’re hitting your target ROI—typically 15%+ for flips or 8%+ cap rate for rentals.

🔐 4. Bidding Smart to Win—Without OverpayingOnline auctions can get competitive fast. Stay sharp by:- Setting a firm max bid limit based on your profit margin

- Avoiding bidding wars that push past your ROI target

- Watching for bid extensions (common in timed auctions)

- Making sure all due diligence is complete before you bid

- Some investors use “sniper” tactics to bid in the final seconds—but always be prepared to walk away if numbers don’t work.

📁 5. Post-Auction Steps for a Smooth CloseIf you win, you'll typically need to:- Submit earnest money within 24–48 hours

- Finalize financing (or pay cash)

- Schedule any final inspections

- Close within 30 days (standard for auctioned assets)

- Begin renovations or tenant placement immediately

- The faster you move, the sooner you start building equity or generating cash flow.

🎯 Conclusion & Call to ActionOnline real estate auctions offer a powerful opportunity for investors to acquire discounted properties, expand into new markets, and close deals faster. By leveraging smart data, sticking to your numbers, and using auctions strategically, you can turn digital bidding into real-world profits.Ready to find your next investment?→Browse Our Upcoming Investment AuctionsRead More -

-

The Ultimate Guide to Buying Your First Home at Online Auction

-

- Andres McBeth

- 2025-05-29T04:00:00Z

- Share

Everything first-time buyers need to know to confidently purchase property in a competitive digital marketplace.Buying your first home is exciting—but it can also feel overwhelming. With rising property prices and bidding wars in traditional markets, more first-time buyers are turning to online real estate auctions as a faster, often more affordable alternative. But how do these auctions work? And how can you avoid costly mistakes?This guide will walk you through every step of the process—from registration to closing—so you can bid with confidence.🔑 1. What Is an Online Real Estate Auction?Online auctions allow you to bid on homes just like you would on eBay—but with much bigger stakes. Properties are listed on auction platforms with photos, disclosures, inspection reports, and a set auction date. Buyers place bids in real time, and the highest qualified bidder wins—subject to seller approval or reserve pricing.Benefits:- Transparent pricing and bidding

- Faster transaction timelines

- Potential below-market deals

- Access to both listed and off-market properties

📝 2. How to Register and PrepareBefore you can bid, you’ll need to register with the auction platform. Most require:- Proof of identity (driver’s license, etc.)

- A pre-approval letter or proof of funds

- Agreement to terms and conditions

- A refundable bidder deposit (usually held on your credit card)

- Once registered, browse available listings and select properties of interest. Most platforms host virtual tours, disclosures, and detailed due diligence packets to help you make informed decisions.

🔍 3. Do Your Due DiligenceUnlike traditional sales, many auction properties are sold as-is—so it's crucial to review all information provided:- Property condition reports and photos

- Title status (free and clear, liens, HOA fees)

- Neighborhood comparables

Auction terms (reserve vs. no-reserve, buyer premium)Pro Tip: Ask if you can schedule a pre-auction inspection. Some properties may allow this with the seller’s permission.💸 4. Bidding Like a ProOnce the auction opens, bidding usually lasts a few days, ending with a countdown timer. To stay competitive:- Set a maximum bid and stick to your budget

- Watch for “bid extension” features (to avoid last-minute sniping)

- Monitor competing bids via live dashboards

- Be ready to win—your offer may become binding once the auction closes

- Buyer’s Premium: Some auctions charge an additional percentage (e.g., 1-5%) on top of your winning bid. Make sure to factor this into your total budget.

🏁 5. After the Auction: What Happens Next?If you win, here’s what typically happens:- Sign a purchase agreement (within 24–48 hours)

- Submit your earnest money deposit

- Complete inspections (if allowed post-auction)

- Finalize your mortgage or pay in cash

- Close the transaction (often within 30 days)

- If you don’t win, your deposit is refunded and you're free to bid on other properties.

🎯 Conclusion & Call to ActionBuying your first home through an online auction doesn’t have to be risky. With the right preparation and mindset, it can be one of the smartest paths to homeownership—offering transparency, speed, and sometimes a great deal.Ready to start bidding?Register Now and Browse Upcoming Residential Auctions.Read More -

- Result Per Page:

.jpg)

.jpg)